|

|

|

Expected to Work/Barriers to Full Employment Policy & Procedures |

Published Date: May 31, 2019

Bookmark this page |

18 Overpayment, Debt and Recovery |

|

Authority Level for Exempting Repayment

Income and Employment Support Act (IESA), section 35

INTENT

To establish delegated authority levels for exempting the requirement to repay an assessed overpayment.

POLICY

The director’s authority to exempt repayment is delegated to program staff, with decisions subject to review by an Appeal Panel. Refer to the Criteria for Exempting the Requirement to Repay an Overpayment policy section.

Note

This policy does not apply to debts. In addition, overpayments that result from fraud, wilful misrepresentation, sponsorship default or a signed Repayment Agreement do not qualify for an exemption on repayment.

The delegation structure allows staff to approve repayment exemptions on set overpayment amounts and circumstances that are commensurate with the accountability level for their position.

Level One (Worker)

Workers are authorized to exempt repayment of an overpayment only in the following two types of circumstances:

- Overpayments valued at less than $50 for each Period of Assistance (POA). This includes overpayments that accumulate over numerous POA, to a total of $50 or greater, but are less than $50 for each month.

Note

When an overpayment spans several POA and the amount overpaid is greater than $50 for any given month, the worker considers the overpayment as a whole and refers the decision to exempt repayment to the next authority level. - Time elapsed is greater than three years. If an overpayment, in its entirety, is for a period older than three years from the date it is discovered, the decision to exempt repayment is delegated to the worker. If the overpayment stretched back farther than three years, but continued within the last few years, then the overpayment is not considered to be older than three years and repayment cannot be waived.

Level Two (Supervisor)

As the next level of authority above the worker, the supervisor can waive the requirement to repay an overpayment which has a somewhat higher level of complexity.

In addition to the authority of Level One, the supervisor can exempt repayment for overpayments caused by purely program administrative error (i.e. staff error or IT system issues). “Pure administrative error” has specific parameters that the overpayment was caused solely by oversight or error on the part of the program. Overpayments in this category cannot be attributed to the actions/inactions of the client in any way.

Supervisors can exempt pure administrative errors in an amount up to $400 for each Period of Assistance (POA). This includes overpayments that accumulate over numerous POA, to a total of $400 or greater, but which are less than $400 for each month.

Examples that would qualify for exemption under a pure administrative error include the following.

- A client notifies the program that they earned $400 in monthly employment income. The worker accidentally enters $40 in the system and discovers that the client was overpaid for one month.

- Two clients with the same name have their files mixed up and one client receives the other client’s higher benefit amount. The client who received the higher benefit amount notified their worker about the error immediately.

If there is uncertainty about whether the circumstance qualifies as a pure administrative error or whether there is some component of client action/inaction that contributed to the overpayment, the decision about potential waiver of repayment should be referred to Level Three (Manager).

Level Three (Manager)

As the next level of authority above the supervisor, the manager can waive the requirement to repay an overpayment which has a higher level of complexity. The manager has discretion to consider all circumstances (even those beyond pure administrative error) to exempt repayment.

In addition to the authority of Level Two, the manager can exempt repayment of any overpayment, as long as the total value is less than six months of total core benefits and as long as the overpayment is deemed appropriate to be waived according to the Criteria for Exempting the Requirement to Repay an Overpayment policy.

“Total core benefits” refers to the maximum Core Essential + Core Shelter amount (private shelter rate) that a household can receive each month, based on client-type and family composition.

Level Four (Statutory Director)

Under IESA section 35, the Statutory Director has authority to consider waiver for all overpayments, provided that the overpayment was not caused by fraud or wilful misrepresentation on the part of the client. There is no limit on the dollar amount or cause of the overpayment.

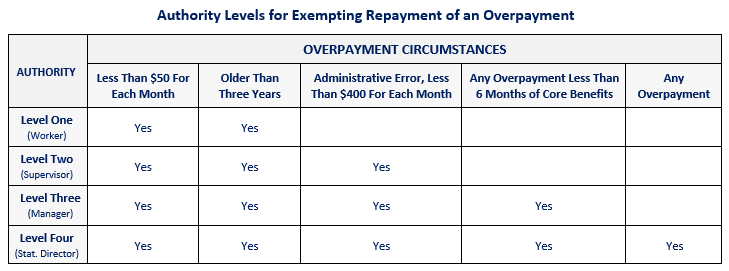

The chart below summarizes the authority levels for exempting repayment.

|

|

Previous

Previous